What’s your Seattle area home worth? Are you thinking of selling your home or interested in learning about home prices in your neighborhood? I can help you. Discover Market Value

If you’re confused by buyer’s agent’s commissions after the NAR lawsuit & settlement, you are not alone.

After the real estate world made headline news across the nation with the settlement of a commission lawsuit against the National Association of Realtors and all major brokerages, we’ve received tons of questions from concerned sellers, wondering if they should pay buyer commissions any longer. As with many major headline stories, many important details haven’t filtered past the headlines to provide practical, actionable details you can use.

In short, especially here in the Northwest very little is changing as we’ve been leaders in providing transparency for sellers and buyers on commissions and compensation, and many of our practices are being adopted in other parts of the nation post settlement. However, we’re finding most clients are not focused on the logistics, they simply want to know how to get the best outcome for their sale in today’s evolving market.

Saving vs. Investing

First let’s acknowledge, spending less is almost always a good feeling, and we can respect instincts to “save money” through opting for lesser priced goods or services. However, we also know investing in r quality goods and services is often more profitable in the long run, whether it’s something which lasts longer or guidance from a more experienced advisor which better fits your specific needs and goals.

So, how do you choose when to focus on saving vs. investing when making a big decision?

Most people focus on referrals and reviews from people with similar experiences to help guide the decision, and with market data we can provide unbiased reviews on how compensation offers can perform for you.

Market Data Informing Decisions

For nearly 10 years we’ve tracked the trends on compensation offered to buyer brokers. We’ve measured how these offers affected the outcome of listings, especially when it comes to sale price performance, days on market and net proceeds for sellers. Through this research we help clients move from feeling to informed with reliable actions.

99% of All Listings Offered 2-3% Buyer Broker Compensation

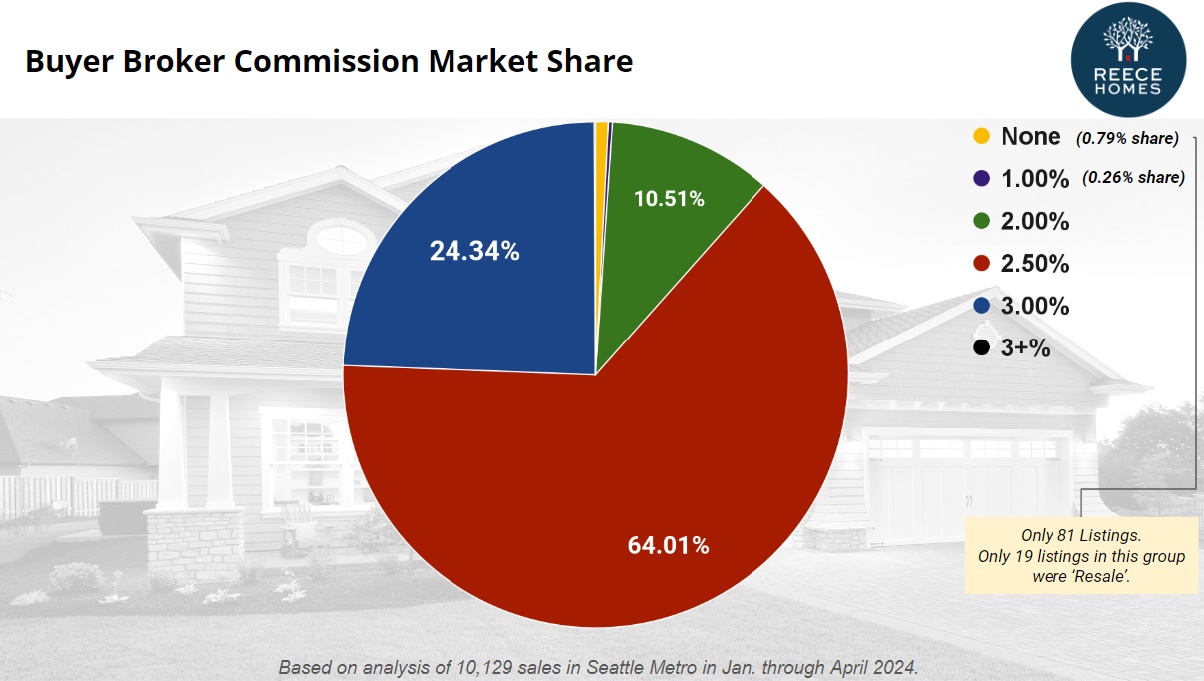

In our most recent analysis of more than 10,129 closed sales in the region from January through April of this year, we found 99% of all sellers offered 2% to 3% compensation to buyer brokers with their listing.

Only 81 listings offered no commission, and the vast majority of these were one national home builder i n the area who prefers working with unrepresented buyers and has not offered compensation for years.

Resale Listings With No Compensation Took Longer To Sell & Sold For Less

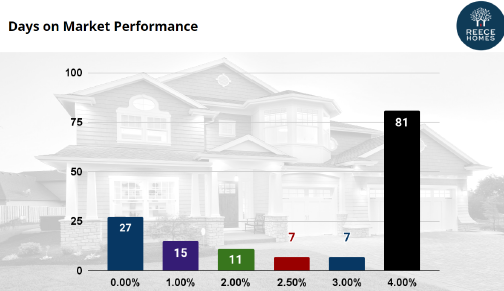

So less than 0.2% of all resale homes offered no compensation to buyer brokers, and the median time on the market for these homes was 27 days compared with 7 days for those offering 3% or 2.5%. Additionally, their list to sale price ratios were about 2.24% less than those listings offering 3% compensation to buyer brokers.

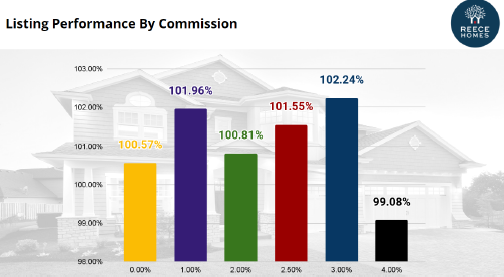

3% Commission Offerings Delivered Higher Prices

On average, listings with 3% commission offerings to Buyer Brokers delivered 102.24% list to sale price ratios, outperforming 2.5% (101.55%) and 2.0% (100.81%). While 1% commissions seemed to perform well, keep in mind this was less than 50 listings (0.26% of the overall) market, so the dataset is so small its accuracy is not likely to be reliable.

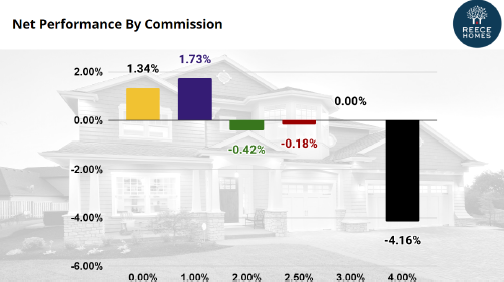

How Will This Impact Net Proceeds?

Of course, net proceeds are a very important factor for most sellers, so we looked at how 3%, 2.5% and 2.0% compared when you factor the savings. On average, listings offering 3% buyer broker compensation provided 0.18% more net proceeds than a 2.5% listing, and 0.42% more net proceeds than those offering 2.0%. For a median priced $850,000 this is $1,500 to $3,600 more at closing, respectively.

How Long Will It Take?

Another key factor is time on market, and here 3% and 2.5% listings performed equally well with a median time to contract of 7 days with 2.0% listing lagging with 11 days on market.

I’ll Just Pay More!

What about 4%… well those listings only account for .08% of the market and took 81 days to get in contract and delivered 4.16% less than 3% listings. Lesson here… lower your price, don’t try to ‘bonus’ a buyer broker to sell your home for more than market value.

What’s Next?

Of course, every market is different and these stats evolve over time, so what might work for the region may not work for your neighborhood or price point, so talk to us and we can dive deeper to get you the stats you need to find the best approach.

You Lead the Way

Since it’s our job to help clients take the most reliable path to optimal results, based on the latest data we are recommending our offer competitive compensation to a buyer broker as the most likely means to the highest net proceeds in their sale.

That said, while this is what we consider current best practice, we are always happy to help clients ‘ innovate’ so long as we provide the information and perspective so they understand the risks and rewards of different approaches.

If you have any questions, or would like to see how your local market is performing, please reach out and we’ll be happy to answer your questions and devise a great strategy for you.